Image courtesy of Pixabay.

Bitcoin is becoming an active asset in the Decentralized Finance (DeFi) ecosystem. For a long time, it had been assumed that bitcoin was to be only a digital gold and nothing more. That is changing. As more bitcoin holders look for ways to earn yield, lending dApps built on Bitcoin and the Bitcoin Layer 2 networks that support it are gaining traction.

For years, bringing DeFi to Bitcoin was a challenge due to the network’s design. Unlike Ethereum, built with smart contract functionality from the start, Bitcoin’s scripting language is intentionally limited to prioritize security and decentralization. This made it difficult to build complex financial applications directly on Bitcoin without relying on centralized intermediaries.

However, advancements in Bitcoin Layer 2 solutions like Stacks and Rootstock (RSK) have changed the landscape. These technologies enable smart contract functionality and scalable transactions while still settling on Bitcoin’s secure base layer. As a result, DeFi on Bitcoin is now possible in a trust-minimized way, allowing users to lend, borrow, and earn yield without leaving the Bitcoin ecosystem.

Whether you want to put your bitcoin to work or access liquidity without selling, these five Bitcoin DeFi lending platforms are worth checking out.

Zest Protocol

Zest Protocol was developed and launched in 2022 to bridge the gap between bitcoin and DeFi, and it is growing into a platform that provides a robust lending infrastructure for bitcoin holders looking for ways to diversify within the ecosystem.

The protocol allows users to earn yield on their bitcoin or borrow against it. Operating entirely on-chain, Zest Protocol’s smart contracts ensure transparency and security while enabling institutional-grade lending pools.

Key Features:

- Bitcoin-native yield opportunities

- Institutional-grade lending pools

- Transparent and secure borrowing environment

Website: https://www.zestprotocol.com/

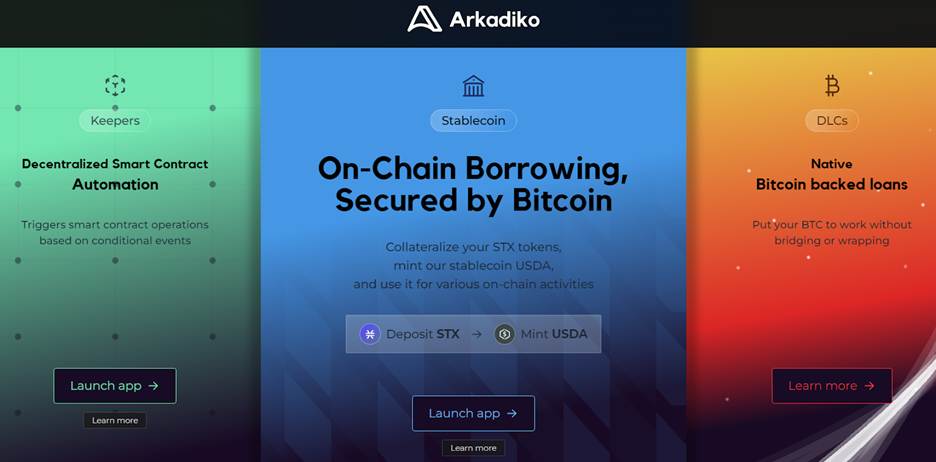

Arkadiko

Arkadiko was launched in 2021 and quickly gained traction for its innovative self-repaying loan mechanism, enhancing Bitcoin’s utility in DeFi.

This DeFi platform allows users to mint the stablecoin USDA by locking up collateral such as STX tokens, enabling users to leverage their assets without needing to sell them. The application is built on the Stacks L2.

Key Features:

- Mint stablecoins by locking collateral

- Maintain exposure to underlying assets

- Built on Stacks for Bitcoin compatibility

Website: https://arkadiko.finance/

Sovryn

Launched in early 2021, Sovryn became one of the first major Bitcoin DeFi platforms. Originally built on Rootstock (RSK), it brings Ethereum-like DeFi capabilities to Bitcoin while maintaining the decentralization and security of the Bitcoin network.

Sovryn offers a suite of financial services, including lending, borrowing, and margin trading, all secured by the Bitcoin network.

Key Features:

- Bitcoin-backed lending and borrowing

- Non-custodial and trustless DeFi services

- Integrated margin trading for BTC

Website: https://sovryn.com/

Granite

Granite, launched in 2023, quickly gained attention for its focus on security and decentralization, offering more ways for Bitcoin holders to earn yield.

As a Bitcoin Liquidity Protocol, Granite provides a non-custodial and secure way to borrow against Bitcoin. It allows borrowers to take stablecoin loans using Bitcoin as collateral, eliminating counterparty or rehypothecation risk.

Key Features:

- Decentralized Bitcoin lending

- Secure and permissionless borrowing

- Support for various bitcoin-backed assets

Website: https://granite.world/

Coinbase Borrow (Morpho)

Coinbase Borrow launched in 2020 as part of Coinbase’s expansion into lending services, while Morpho was introduced in 2022 to improve capital efficiency and yield generation in decentralized finance.

Coinbase Borrow is built using the infrastructure made available by Morpho, but the transactions are partly processed on the Base network. Morpho enhances the efficiency of lending protocols through its on-chain mechanisms. The service allows users to take out loans using Bitcoin as collateral. Users can instantly borrow up to $100,000 in the USDC stablecoins.

Key Features:

- Borrow up to $100,000 in USDC using Bitcoin as collateral

- No fixed repayment schedules; repay at your own pace

- Variable interest rates determined by market activity

Website: https://morpho.org/

Bottom Line

As Bitcoin DeFi continues to mature, platforms like Zest Protocol, Arkadiko, Sovryn, Granite, and Coinbase Borrow with Morpho are pioneering innovative solutions for bitcoin holders. These platforms offer diverse services, from earning yield and minting stablecoins to accessing liquidity without selling bitcoin.

By leveraging these DeFi solutions, users can unlock new financial opportunities while maintaining control of their assets in a decentralized ecosystem.

Everything You Need to Know About Education Loan

Everything You Need to Know About Education Loan